BPO in Insurance: Lower Costs, Boost Efficiency, and Scale Smarter

Are rising operational costs, heavy administrative workloads, and increasing customer expectations stretching your insurance operations thin? BPO in insurance is the strategic solution that allows carriers, agencies, and MGAs to streamline operations, reduce expenses, and elevate the customer experience—without sacrificing control or compliance.

TL;DR — What You Need to Know About BPO in Insurance

- What it is: Partnering with a specialized provider to manage insurance operations like claims processing, policy administration, underwriting support, and customer service.

- Why it matters: Reduces operational costs by 40–60%, improves efficiency, and enables on-demand scalability.

- What to outsource: FNOL intake, renewals, endorsements, underwriting prep, and 24/7 policyholder support.

- Why nearshore wins: Time-zone alignment, bilingual talent, cultural compatibility, and major cost savings—without offshore communication gaps.

Are you drowning in endless administrative tasks, rising operational costs, and the constant pressure of customer demands? For many in the insurance world, the answer is a hard yes. That’s where Business Process Outsourcing (BPO) in insurance comes in—it’s the strategic move where firms team up with specialized providers to handle essential, non-core functions. This frees up your internal teams to zero in on what really drives the business: growth and client relationships.

TL;DR: What You Need to Know About BPO in Insurance

- What it is: BPO in insurance involves partnering with a specialized provider to handle key operations like claims processing, policy administration, and customer support.

- Why it matters: It drastically reduces operational costs (by 40-60%), provides on-demand scalability for busy periods, and gives you access to expert talent and technology without the upfront investment.

- What to outsource: Core functions ripe for outsourcing include claims intake (FNOL), policy renewals, underwriting support, and 24/7 customer service.

- Why Nearshore BPO wins: The nearshore model (e.g., in Tijuana) offers the ideal balance of significant cost savings, time-zone alignment for real-time collaboration, and bilingual, culturally-aligned agents.

What BPO in Insurance Really Means

What BPO in Insurance Really Means

At its heart, BPO in insurance isn’t just about handing off tasks; it’s about sharpening your competitive edge. Think of it like adding a highly skilled, specialized extension to your team but without all the overhead of hiring, training, and building out infrastructure. Your BPO partner takes full ownership of critical back-office and front-office operations—the stuff that’s vital for success but often drains your most valuable resources.

This kind of strategic partnership allows insurance carriers, agencies, and MGAs to shift their focus away from routine paperwork and toward high-value activities. Things like product innovation, complex risk assessment, and strengthening broker networks. It’s a fundamental change from trying to do everything yourself to excelling at what matters most.

How BPO in Insurance Modernizes Operations

Let’s be honest, the insurance industry is under immense pressure. Customers expect instant, seamless service around the clock, and the regulatory goalposts are always moving. To keep up, you have to be both agile and ruthlessly efficient.

This is where a modern BPO in insurance strategy becomes a game-changer. It’s no longer just a cost-cutting play; it’s about gaining access to deep expertise and technology that deliver real, measurable improvements. For a closer look at the basics, you can learn more about what Business Process Outsourcing is and how it works as a strategic lever for growth.

The modern goal of insurance BPO is not just cost reduction, but value creation. It transforms fixed operational costs into a flexible service that scales with your business needs, enhancing both efficiency and service quality.

Core Insurance Functions Ready for Outsourcing

To give you a clearer picture, here’s a quick look at some of the key insurance functions that are prime candidates for outsourcing and the immediate value they deliver.

| Outsourced Function | Description | Practical Business Benefit |

|---|---|---|

| Claims Processing | Managing the claim from First Notice of Loss (FNOL) all the way to settlement and payment. | Faster turnaround times, improved accuracy, and higher claimant satisfaction. |

| Policy Administration | Handling day-to-day tasks like policy issuance, renewals, endorsements, and cancellations. | Enhanced compliance, reduced administrative burden, and greater operational consistency. |

| Customer Support | Providing 24/7 multilingual support for policyholders via phone, chat, and email. | Improved customer satisfaction and loyalty through responsive, expert service. |

| Underwriting Support | Assisting underwriters by gathering applicant data, ordering reports, and managing workflows. | Accelerated underwriting decisions and increased capacity for core underwriting teams. |

By offloading these process-heavy functions, you not only improve efficiency but also create the breathing room your team needs to focus on strategic initiatives that truly move the needle.

What Can You Outsource? A Look at Core BPO Services in Insurance

While the idea of outsourcing is simple enough, the real value of BPO in insurance comes from the specific, high-impact services a partner can take over. These aren’t just minor administrative tasks; they’re the very engine room of an insurance company.

When you hand these functions to a specialized team, they stop being mere cost centers. Instead, they become drivers of efficiency and happier customers. Let’s dig into what these core services actually look like and how a strategic BPO partnership changes the game, freeing up your in-house experts to focus on growing the business.

How BPO Transforms Claims Processing

The claims experience is often the single most important interaction a policyholder has with their insurer. A clunky, slow process can poison the well for good, but a smooth one builds incredible loyalty. This is where BPO partners shine—they specialize in optimizing this entire workflow.

Think about a standard auto claim. Your in-house team is likely juggling incoming calls, manually entering First Notice of Loss (FNOL) details, and painstakingly verifying every piece of information. With a BPO partner, that chaos disappears.

- FNOL Intake: A dedicated team is on standby 24/7 to take that first call, ensuring every claimant gets a fast, empathetic response, no matter the time of day.

- Data Verification: The BPO team gets to work checking policy details and gathering documents, making sure everything is accurate before it ever lands on your adjuster’s desk.

- Status Updates: Agents proactively keep claimants in the loop, which dramatically cuts down on the “just checking in” calls that bog down your core staff.

This disciplined approach can slash claim cycle times from weeks down to just days. Much of this improvement comes from leveraging technology like automated claims processing, which cuts down on human error and gets claims resolved faster.

Policy Administration and Lifecycle Management

The daily grind of managing insurance policies—endorsements, renewals, cancellations—is a relentless, detail-heavy job. A BPO partner brings a ton of discipline and focus to these critical back-office functions.

Practical example: Take renewal season, for example. It’s a period that can easily swamp an internal team. A BPO partner can own that entire peak period, managing renewal notices, processing payments, and handling all related inquiries. This keeps the customer experience seamless and prevents your team from getting pulled away from more strategic initiatives. To see how this fits into a larger strategy, check out our guide on insurance process outsourcing.

Smart BPO isn’t just about offloading work. It’s about giving processes to experts who can run them faster, more accurately, and more efficiently—turning an operational need into a real competitive edge.

Underwriting Support and Data Management

Your underwriters are some of your most valuable people, but their time is constantly eaten up by administrative tasks. BPO services provide the backup they need to focus purely on what they do best: assessing risk.

An outsourced support team can handle the prep work:

- Data Gathering: Compiling applicant info and ordering reports like MVRs or credit checks.

- File Preparation: Organizing all the submission data into a clean, consistent format for the underwriter.

- Workflow Management: Triaging submissions based on your criteria so underwriters always tackle the most important cases first.

This support system dramatically speeds up decision-making and boosts the number of policies an underwriter can review. The Property and Casualty (P&C) sector, in particular, has leaned into this model. In fact, P&C insurance is the biggest adopter of BPO globally, making up a massive 44.12% of the market because its operations are so transaction-heavy.

Why BPO in Insurance Is a Smart Business Move

Knowing what you can outsource is one thing, but the real question is why your insurance firm should even consider it. Partnering with the right BPO is about building a sharper, more efficient, and customer-obsessed operation from the ground up.

Think of it as transforming your biggest operational headaches into your greatest competitive strengths. We can break down the advantages into four key pillars that every modern insurer grapples with, from tight budgets to wild swings in demand.

Drastic Cost Reduction for BPO in Insurance

Let’s be blunt: the most immediate win with insurance BPO is a major drop in operational costs. You’re essentially swapping heavy, fixed expenses like payroll and real estate for a flexible, predictable operational cost.

Just think about what an in-house team really costs. It’s not just their salaries. You’ve got benefits, office space, IT gear, software licenses, and endless training cycles. A BPO partnership wipes those overheads off your books. You pay for the service you need, exactly when you need it, which can slash your operational spend by 40-60%. You can learn more about how to calculate the ROI of outsourcing call centers to save time and money in our detailed guide.

Seamless Scalability on Demand

The insurance world is anything but steady. You have predictable peaks during open enrollment, massive surges after a natural disaster, and seasonal spikes in claims. Hiring full-time staff to sit around waiting for these moments is a massive waste of money.

This is where a BPO partner gives you incredible agility.

- Practical example (Storm Season): A hurricane hits, and claim volumes explode overnight. Instead of panicking, your BPO partner can instantly add dozens of trained claims intake specialists to handle the flood, ensuring every policyholder gets a fast response.

- Practical example (Open Enrollment): During this make-or-break period, a BPO can deploy a dedicated team to field inquiries and process applications, keeping your pipeline clean and your customers happy.

This power to scale your workforce up or down in a flash means you’re never overstaffed during the lulls or drowning during the rushes.

Access to Specialized Talent and Technology

Let’s face it, building an expert team and investing in top-tier technology is a huge undertaking. Finding—and keeping—top claims processors, licensed agents, and data analysts is tough. A BPO partner hands you both on day one.

They’ve already done the hard work of recruiting and training specialists who live and breathe insurance. And it’s not just about back-office work; BPO providers offer deep expertise in navigating tricky areas like Insurance Industry Regulatory Compliance, making sure you stay on the right side of the rules. The global insurance BPO market was valued at USD 10,388.45 million and is expected to hit USD 23,940.55 million by 2033. This growth is fueled by insurers looking for an edge in efficiency and expertise.

An Elevated Customer Experience

In today’s market, customer experience is everything. Policyholders don’t just want service; they expect it to be fast, smart, and empathetic. A great BPO partner is built to deliver just that. Their teams are laser-focused on customer interaction, and they live by metrics like First Call Resolution (FCR) and Customer Satisfaction (CSAT) scores to constantly get better.

When you have a specialized team handling customer calls and claims updates 24/7, you deliver a consistently high-quality experience. This frees up your in-house experts to focus on the most complex, high-value cases, boosting service levels and locking in policyholder loyalty.

Why the Nearshore Model Is a Game-Changer for BPO in Insurance

When you’re choosing a BPO partner, location is way more than just a pin on a map. For insurers in North America, the nearshore model cuts through the old onshore vs. offshore debate. A nearshore partner in a location like Tijuana, Mexico, gives you the cost savings of outsourcing but with the smooth, easy collaboration of an in-house team.

Time Zone Alignment Is Everything

In insurance, things move fast. Real-time collaboration isn’t a “nice-to-have”—it’s a necessity. Waiting 12 hours for an offshore team to start their day just won’t cut it. That’s where a nearshore partner operating on the same business clock completely changes the game.

This shared time zone means your teams can work together instantly. You can pick up the phone, hop on a video call, or fire off an email and get a response in minutes, not tomorrow. This alignment gets rid of communication delays and makes your outsourced team a genuine, integrated part of your daily workflow.

Cultural Affinity and Bilingual Talent

Great communication in insurance isn’t just about speaking the same language; it’s about understanding the cultural subtext. Nearshore agents have a natural cultural affinity with the North American market, which lets them handle customer conversations with an empathy and context that teams halfway across the world might miss.

On top of that, a great nearshore location like Tijuana offers a deep pool of bilingual talent, fluent in both English and Spanish. This is a massive advantage for serving an increasingly diverse customer base in the United States. Learn more about the benefits of nearshore outsourcing in our detailed guide.

A nearshore BPO in insurance isn’t just about cutting costs; it’s a strategic move to lock in real-time collaboration and build stronger customer connections.

Cost-Effectiveness Without Compromise

Let’s be honest, the conversation around outsourcing usually starts with the budget. And this is where the nearshore model really finds its sweet spot. It offers big savings over pricey onshore operations but without the communication headaches and time zone gaps that can make offshore partnerships a struggle.

- Onshore: Highest cost.

- Offshore: Lowest cost, but often with communication hurdles.

- Nearshore: The ideal balance. You get major cost savings while keeping the time zone and cultural sync that’s so critical for top-tier service.

By going nearshore, North American insurers truly get the best of both worlds: a budget-friendly solution that doesn’t force them to sacrifice the quality of their collaboration or their customer experience.

How to Choose the Right Insurance BPO Partner

Picking a BPO partner for your insurance operations is a massive decision. It’s not just about farming out a few tasks; it’s about entrusting a piece of your business—and your brand’s reputation—to someone else. This isn’t about finding the cheapest vendor. It’s about finding a true strategic partner who gets the high-stakes world of insurance.

Assess Their Genuine Industry Expertise

Let’s be clear: not all BPO providers are the same. In insurance, you need a specialist. A partner with deep insurance acumen already knows the terminology, the regulatory headaches, and the specific workflows unique to your business. They should speak your language from day one. That means they know the difference between an FNOL and a subrogation claim and understand why compliance is non-negotiable.

Verify Ironclad Data Security

In the insurance world, data is everything. You’re handling incredibly sensitive policyholder information, and one breach can be catastrophic. Any BPO partner you consider must have an unwavering, verifiable commitment to data security.

Don’t just take their word for it—demand proof. Ask to see their certifications. You’re looking for compliance with key industry standards:

- SOC 2: Confirms they have robust systems to secure and protect client data.

- PCI DSS: Absolutely essential if they’ll be handling any credit card or payment information.

- HIPAA: A non-negotiable if they will have any access to protected health information (PHI).

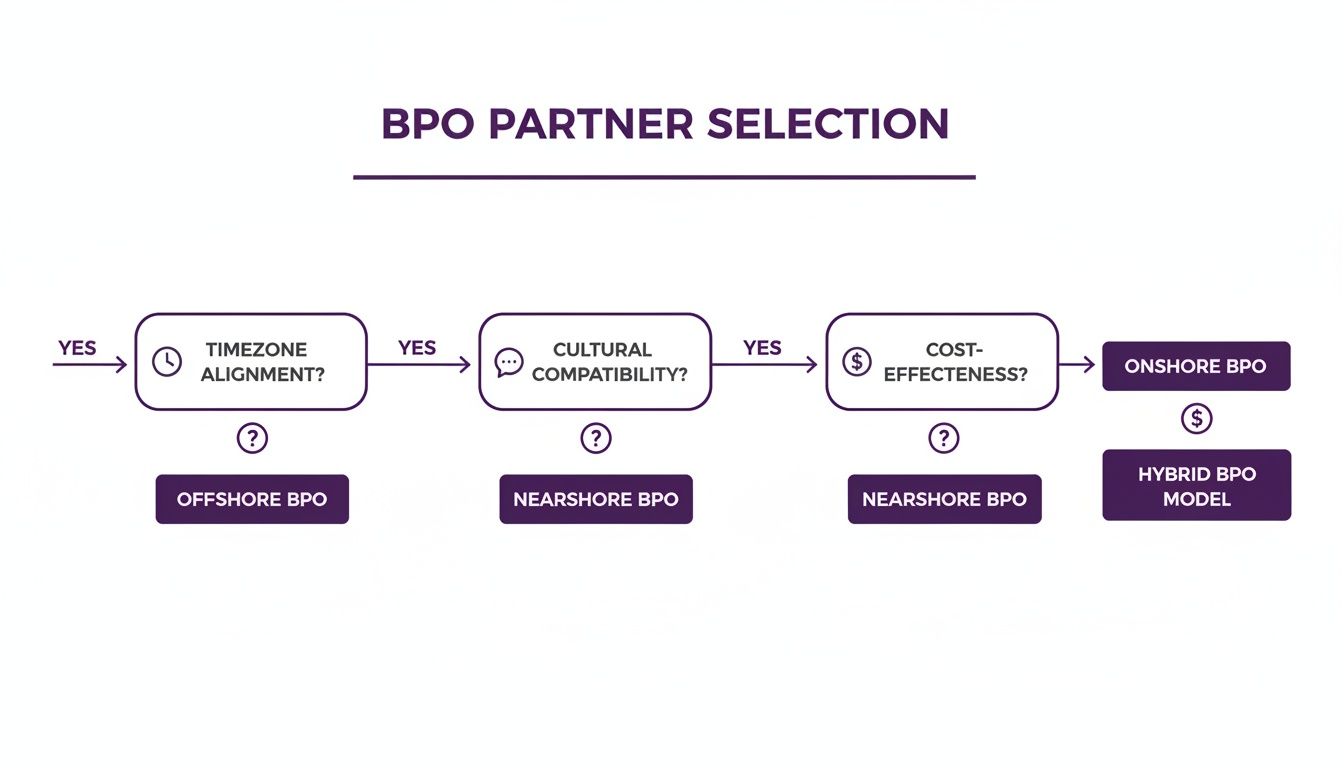

This decision tree shows how key factors like timezone, culture, and cost play a role in selecting the right BPO partner.

As the visual shows, the sweet spot is usually at the intersection of cultural and time-zone alignment, where you get a cost-effective solution without cutting corners on quality.

Evaluate Their Technology Stack

An effective BPO partner uses modern, reliable technology to keep things running smoothly. As you vet potential partners, make sure to ask about the platforms they use for communication, workflow management, and reporting. Do they have real-time dashboards where you can check on performance? Are their systems going to play nice with yours? A forward-thinking partner invests in technology that makes your life easier, not harder.

Your BPO partner is an extension of your brand. Choose a partner whose commitment to security, expertise, and quality mirrors your own.

Critical Questions to Ask Potential Partners

To properly vet potential providers, you need to go in armed with questions that cut right to the heart of the matter.

- Can you provide case studies of insurance clients with needs similar to ours?

- How do you train your agents on our specific policies and brand voice?

- What are your data security and disaster recovery protocols?

- How are your Service Level Agreements (SLAs) structured?

- What is your agent attrition rate?

For an even deeper look at the vetting process, check out our guide on how to find and vet the best call center outsourcing companies, which has more great evaluation tips.

Common Questions About BPO in Insurance

Making the leap to a BPO partnership is a big move. It’s natural to have questions. To give you some clarity, here are the straight answers to the most common concerns we hear from insurance executives.

Will Outsourcing Mean Losing Control Over My Brand’s Service Quality?

This is probably the number one concern, and it’s a fair one. But the right BPO partner doesn’t just take tasks off your plate; they become a steward of your brand. They work with you to bake your brand voice, culture, and quality standards into their operations. A true partner gives you full visibility. Through shared dashboards, transparent reports, and regular check-ins, you always know how things are going.

How Secure Is My Policyholder and Company Data?

For any BPO worth its salt, data security is non-negotiable. Leading providers invest millions in it and hold certifications like SOC 2, PCI DSS, and HIPAA to prove it. This is not an area where you cut corners.

A BPO partner’s security shouldn’t just meet your standards; it should exceed them. They should be able to demonstrate a multi-layered defense strategy covering physical, network, and data-level protection.

At CallZent, our entire infrastructure is built around protecting sensitive information. We use multi-layered security protocols—from encrypted networks and strict access controls to secure facilities—to ensure your data is locked down.

What Does the Transition Process Actually Look Like?

An experienced BPO partner makes the transition feel less like a chaotic scramble and more like a well-managed project. It’s a structured, phased approach designed to eliminate disruptions.

It usually breaks down into four key stages:

- Discovery and Mapping: We do a deep dive to map out your current workflows and get crystal clear on your goals.

- Solution Design: We design a custom solution that details the processes, tech, and team structure.

- Implementation and Training: We carefully manage the transition, including comprehensive agent training on your brand.

- Go-Live and Optimization: Once live, we monitor performance against SLAs and use constant feedback loops to keep improving.

Is BPO Only for Large Insurance Carriers?

Not at all. This is one of the biggest myths out there. In reality, scalability makes BPO a powerful tool for small to mid-sized insurers, agencies, and MGAs. Outsourcing gives smaller companies access to enterprise-grade technology and talent that would otherwise require a massive upfront investment. It effectively levels the playing field, letting you deliver a top-tier customer experience and compete with the big players.

Frequently Asked Questions About BPO in Insurance

1. Is BPO secure for insurance data?

Yes—when working with certified providers compliant with SOC 2, PCI DSS, and HIPAA standards.

2. Will I lose control over customer experience?

No. Clear SLAs, QA scorecards, and shared reporting ensure full visibility and quality oversight.

3. How long does implementation take?

Most transitions follow a phased 30–90 day rollout depending on complexity.

4. Can BPO handle catastrophe claim surges?

Yes. Scalability is one of the core advantages of outsourcing.

5. Is BPO only for large carriers?

No. Small and mid-sized agencies benefit from enterprise-level capabilities without enterprise overhead.

6. Can underwriting tasks be outsourced?

Administrative underwriting support functions are commonly outsourced.

7. How do SLAs work?

SLAs define response times, accuracy rates, and service benchmarks with measurable KPIs.

8. What industries within insurance use BPO most?

P&C, health insurance, and life insurance sectors widely leverage outsourcing.

9. What about compliance risks?

Specialized BPO partners maintain regulatory expertise and structured compliance frameworks.

10. How do I choose the right partner?

Evaluate industry expertise, certifications, scalability, attrition rates, and technology infrastructure.

Ready to Transform Your Insurance Operations?

CallZent delivers secure, scalable, nearshore BPO solutions tailored specifically for insurance carriers, agencies, and MGAs. Reduce costs, improve efficiency, and elevate your customer experience today.

Schedule a Strategy Call →Ready to transform your insurance operations with a partner who understands your needs? At CallZent, we provide secure, scalable, and cost-effective BPO solutions from our nearshore location in Tijuana. Explore our solutions today and discover how we can help you reduce costs and elevate your customer experience.

What BPO in Insurance Really Means

What BPO in Insurance Really Means