Call Center Outsourcing Costs

Call Center Outsourcing Costs: The Ultimate 2024 Pricing Guide

A transparent breakdown of call center outsourcing costs, pricing models, hidden fees, and how nearshore partners deliver the highest ROI.

TL;DR: A Quick Guide to Call Center Outsourcing Costs

- Typical Nearshore Rates: $15–$25/hour per agent for high-quality nearshore services.

- What’s Included: Labor, technology, management, QA, training, and infrastructure.

- Pricing Models: Per-seat (predictable), per-hour (flexible), per-resolution (performance-based).

- Location Matters: Nearshore (Tijuana) delivers better ROI than low-cost offshore options.

- True ROI: Factor in retention, FCR, CSAT, and reduced overhead—not just hourly rates.

Struggling to figure out what call center outsourcing really costs?

If you’re looking for a straight answer, you’re in the right place. A quality nearshore call center in a hub like Tijuana typically costs between $15 and $25 per agent per hour. This isn’t just a wage; it’s an all-in rate that bundles skilled agents, technology, management, and training. For most U.S. companies, that translates to a 40-60% savings compared to running an in-house team.

But the final price tag always comes down to your specific needs. This guide will give you the tools to look beyond the hourly rate and calculate the true value of a BPO partnership.

The Real Price of Call Center Outsourcing

Trying to nail down a firm cost for call center outsourcing can feel like aiming at a moving target. You’ll see rates advertised anywhere from under $10 an hour to over $40, which makes it tough to budget or compare vendors apples-to-apples.

The hourly rate is just one piece of the puzzle. The real cost is a blend of direct labor and all the essential operational layers—management, technology, training—that ensure your customers get quality, efficient service.

The global call center outsourcing market has exploded—it’s valued at over $100 billion in 2024 for a reason. Businesses everywhere are looking for smarter ways to manage operational expenses without sacrificing customer experience. Many North American companies are discovering the sweet spot with nearshore partners in hubs like Tijuana, Mexico. These centers deliver skilled bilingual agents and 24/7 service at rates 30-50% lower than U.S. domestic centers, all while maintaining crucial cultural alignment with customers.

Beyond the Hourly Rate: Why Total Cost of Ownership is Critical

Focusing only on the lowest hourly rate is a rookie mistake, and it can be a costly one. This approach completely ignores the total cost of ownership (TCO). A “cheap” service that tanks customer satisfaction, churns through agents, and gives your management team constant headaches isn’t a savings—it’s a liability. And with new tech like AI agents for customer service changing the game, the strategic value of a skilled human-powered partner is more important than ever.

To make an informed decision, you have to look at the whole picture. The complete value proposition includes:

- Labor Costs: Wages for the agents on the front lines handling customer conversations.

- Technology & Infrastructure: The software, hardware, and facilities needed to run smoothly.

- Management & Overhead: The supervisors, trainers, and QA teams who drive performance.

- Training & Compliance: The initial and ongoing coaching required to keep agents sharp and compliant.

“A cheap call center that alienates your customers is an expense; a quality partner that builds loyalty is an investment.”

This holistic view helps you shift from a simple price comparison to a more meaningful value analysis. To see how these pieces fit together, take a look at our full call center outsourcing cost breakdown. It’s the first step toward finding a partner that delivers not just savings, but real, sustainable growth.

Decoding the Four Pillars of Outsourcing Costs

When you get a quote from a potential outsourcing partner, that simple hourly or monthly rate is doing a lot of heavy lifting. It represents an entire ecosystem of services, technology, and talent bundled together. To really compare proposals apples-to-apples, you need to understand what’s under the hood.

Think of it like buying a car. You’re not just paying for the engine; you’re paying for the chassis, the electronics, the safety features, and the team that engineered it all to work together seamlessly. A call center is no different. The final price tag is built on four distinct pillars.

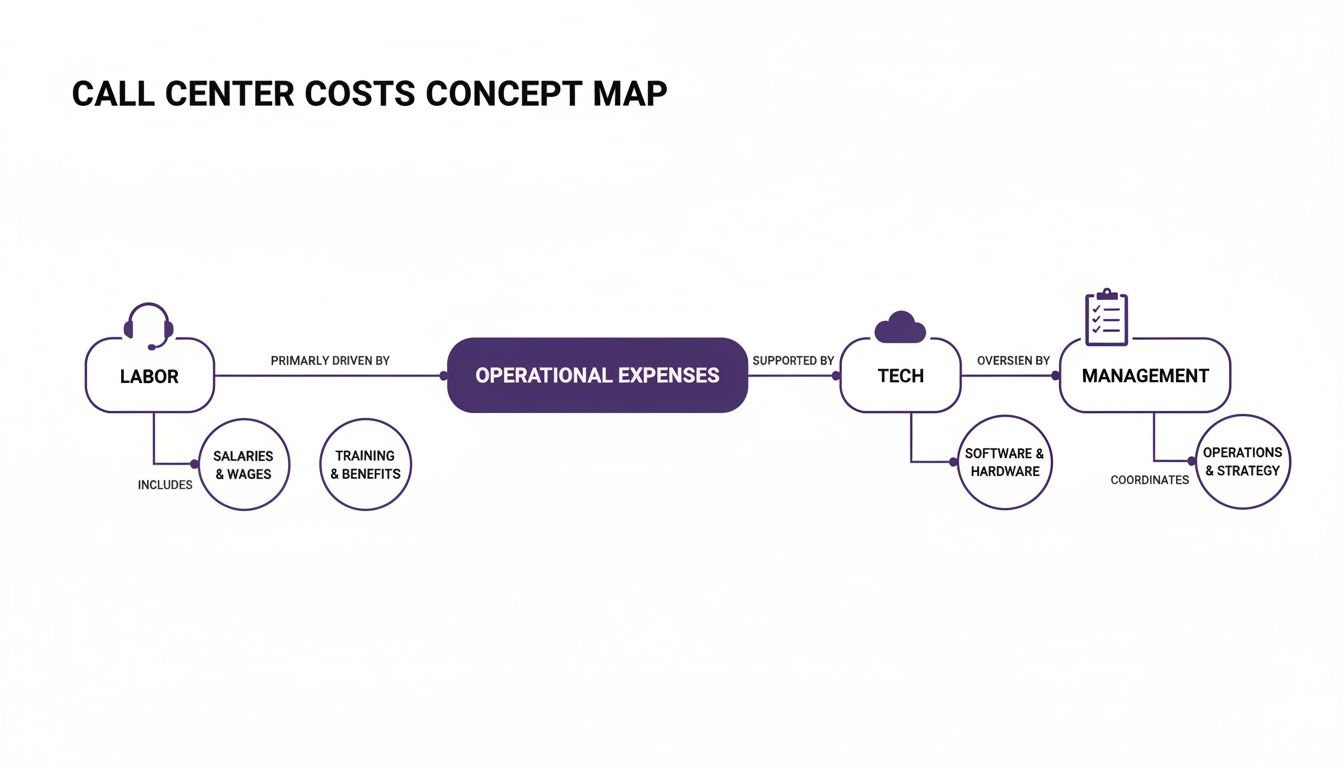

This map breaks down the key cost drivers that make up that all-inclusive rate.

As you can see, the agents are just the starting point. The real value comes from the robust technology and management structure that supports them.

Pillar 1: Direct Labor Costs

This is the most obvious component: the wages paid to the agents fielding your calls, chats, and emails. But it’s not just a flat hourly number. Labor costs are a moving target, heavily influenced by a few key variables:

- Geographic Location: An agent in a nearshore hub like Tijuana has a different cost of living—and therefore wage—than someone in the Philippines or Dallas. It’s all about the local economy.

- Skill Requirements: A general customer service role is priced differently than one needing a licensed insurance agent, a certified tech support specialist, or a fluent bilingual pro. Specialized skills command a higher rate.

- Experience Level: You’ll pay a premium for a veteran agent with a proven track record of hitting sales targets or resolving complex issues on the first call, and that’s often money well spent.

Pillar 2: Technology and Infrastructure

This is the digital and physical backbone holding the entire operation together. It’s all the hardware, software, and facilities needed to deliver reliable and secure service, 24/7. A professional partner invests millions in this area so you don’t have to.

A top-tier outsourcing partner isn’t just a staffing agency; they’re a technology provider, giving you access to enterprise-grade systems without the massive upfront capital investment.

Here’s what this pillar typically includes:

- Software and Licensing: Think CRM platforms, sophisticated call routing systems (ACD), VoIP telephony, and quality assurance software.

- Hardware: This covers everything from agent workstations and professional-grade headsets to the servers and networking gear humming in the background.

- Facility Infrastructure: The physical building itself, plus essentials like redundant power supplies, backup generators, and multiple high-speed internet connections to ensure you never go down.

Pillar 3: Management and Overhead

Agents don’t manage themselves. To get consistent, high-quality performance, you need a dedicated support structure behind the scenes. This pillar covers the “people behind the people”—the coaches, analysts, and leaders who make sure your campaign is a well-oiled machine.

That includes the salaries for:

- Team Leaders and Supervisors: They provide the day-to-day agent coaching, performance tracking, and motivation that keeps everyone on target.

- Quality Assurance (QA) Specialists: These are the experts who listen to calls and review interactions, ensuring agents are sticking to your brand voice and procedures.

- Workforce Management (WFM) Analysts: These are the unsung heroes who handle forecasting and scheduling, making sure you have exactly the right number of agents staffed at all times—no more, no less.

Pillar 4: Training and Compliance

This final pillar is often overlooked but is absolutely critical for long-term success. Training—both initial and ongoing—is what turns a capable agent into a true brand ambassador who understands your customers. This is non-negotiable, especially in regulated industries.

For businesses looking beyond just cost-cutting, understanding how to build a partnership around strategic thinking is key. You can learn more by reading our guide to smart sourcing, which digs into creating a partnership that truly drives business goals.

Here’s what this cost covers:

- Initial Onboarding: Getting new agents up to speed on your company culture, products, services, and unique processes.

- Ongoing Skill Development: Continuous coaching on everything from new product features to advanced soft skills and sales techniques.

- Compliance Training: In sectors like healthcare (HIPAA) or finance (PCI), this specialized training isn’t optional—it’s a requirement to operate legally and safely.

Choosing the Right Pricing Model for Your Business

Call center pricing isn’t a one-size-fits-all deal. The model you choose will have a huge impact on your total spend, your flexibility, and ultimately, whether the venture pays off. Getting it right means matching the vendor’s pricing structure to your company’s unique rhythm of customer demand.

Think of it this way: what works for a seasonal e-commerce brand that’s slammed during the holidays would be a financial disaster for a healthcare provider with a steady, year-round flow of patient calls. Understanding the common models is the first step to building a budget you can stick to.

Let’s break down the three main options you’ll come across.

The Per-Seat or FTE Model: Predictability for High Volume

The Per-Seat model, also called the Full-Time Equivalent (FTE) model, is the most straightforward. You pay a flat monthly fee for each agent who is 100% dedicated to your account. It’s like leasing a fully-equipped office for your customer service team—the cost is consistent and predictable, month after month.

This model is a perfect fit for businesses with a steady, high volume of work that’s easy to forecast. If you know you need ten agents on deck from 9 AM to 5 PM every weekday, the per-seat model gives you unbeatable budget stability.

It’s a great choice for:

- Steady Customer Service Queues: Companies with a consistent stream of calls or chats that need a dedicated team ready to go.

- Long-Term Campaigns: Outbound sales or lead generation efforts that run for months or even years with a fixed team size.

- Complex Support Needs: When your agents need to become true product experts, a dedicated team ensures that hard-won knowledge doesn’t walk out the door.

For example, a national insurance company is a prime candidate for this model. They need a team of licensed agents available during business hours to handle complex policy questions. The call volume is predictable, and the specialized knowledge required makes a dedicated, stable team an absolute must.

The Per-Minute or Per-Hour Model: Flexibility for Fluctuating Demand

The Per-Minute or Per-Hour model is all about usage. Instead of paying for an agent to just be available, you only pay for the exact time they are actively working on a customer interaction—whether that’s on a call, in a chat, or typing an email. This is often called “agent productive time.”

This structure is a lifesaver for businesses with unpredictable or highly seasonal demand. You get the full power of a staffed call center without burning cash on agents sitting around during slow periods. It’s the ultimate pay-as-you-go plan.

It’s a perfect match for:

- Seasonal Businesses: An e-commerce store that makes 80% of its sales in Q4 can scale up for the holiday rush and then scale right back down in January without being locked into a hefty fixed cost.

- New Product Launches: A software company rolling out a new app can anticipate a short-term spike in support tickets and use this model to handle the surge without long-term commitments.

- After-Hours or Overflow Support: Businesses that need to back up their in-house team during peak hours or overnight can use this model for cost-effective coverage.

The Per-Resolution Model: Performance-Based for Specific Tasks

The Per-Resolution or Per-Ticket model is purely performance-driven. You pay a fixed fee for each successfully completed task or outcome. That could be a solved tech support ticket, a qualified sales lead, or a scheduled appointment.

This approach ties your call center outsourcing costs directly to tangible results, making it appealing for specific, transactional campaigns. The catch? You need a crystal-clear, agreed-upon definition of what a “successful resolution” looks like. But when it works, you’re guaranteed to be paying for outcomes, not just effort.

Key Takeaway: The best pricing model isn’t the cheapest one on paper—it’s the one that most closely mirrors your customer demand and business objectives, eliminating waste and maximizing value.

A home services company, for instance, might use this for appointment setting. They pay their partner a flat fee for every qualified appointment that gets successfully booked, directly linking their outsourcing spend to revenue-generating activity.

Which Call Center Pricing Model Is Right for You?

Choosing between these models is a big decision that hinges on your company’s specific needs. There’s no single “best” answer, only the one that aligns with your operational reality.

To help you see the differences at a glance, we’ve broken down the pros and cons of each primary model in the table below. Use it to weigh which structure offers the right balance of cost, flexibility, and performance for your business.

| Pricing Model | Best For… | Pros | Cons |

|---|---|---|---|

| Per-Seat / FTE | Businesses with stable, high-volume, and predictable workloads needing dedicated agent expertise. | Predictable monthly costs, dedicated and highly trained agents, simple to budget. | Can be inefficient if call volume drops; you pay for agent time, not just activity. |

| Per-Minute / Hour | Companies with fluctuating, seasonal, or unpredictable call volumes. | Highly flexible and cost-effective for variable demand; you only pay for productive time. | Budgeting can be difficult; costs can spike unexpectedly during high-volume periods. |

| Per-Resolution | Specific, transactional tasks with clearly defined successful outcomes (e.g., lead gen, appointment setting). | Pay only for results, high ROI for specific tasks, motivates performance. | Not suitable for complex customer service; may incentivize speed over quality. |

Ultimately, the right choice will give you a clear, predictable cost structure that supports your goals without breaking the bank. A good outsourcing partner will walk you through these options and help you land on the model that makes the most sense for you.

Why Location Is a Key Factor In Your Budget

When you’re evaluating call center proposals, you’ll notice one of the biggest cost drivers is location. Where your agents are physically sitting has a massive impact on your budget, team efficiency, and even your customer satisfaction scores. The choice between onshore (in your home country), offshore (far away), and nearshore (just next door) isn’t just about dots on a map; it’s a strategic decision that shapes the entire partnership.

For North American businesses, the nearshore model has become a game-changer, offering a compelling blend of cost savings and operational excellence. It hits the sweet spot—avoiding the sticker shock of domestic operations while sidestepping the logistical and cultural headaches that often come with traditional offshore locations.

The Power of Proximity and Cultural Alignment

Imagine trying to tackle an urgent issue with a team that’s 12 hours ahead of you. By the time your workday kicks off, theirs is winding down. That time zone gap creates frustrating communication delays, drags out problem-solving, and adds friction to everything from daily check-ins to emergency escalations.

Nearshore locations like Tijuana, however, operate in the same time zones as much of the United States (PST, MST, CST). This completely eliminates that barrier. Your outsourced team works when you work, enabling real-time collaboration, instant feedback, and a genuine sense of being one unified team.

But it goes beyond the clock on the wall. Cultural alignment is huge. Agents in nearshore locations share many cultural reference points with US customers, from holidays to consumer trends. This shared context leads to more natural, empathetic conversations and far fewer misunderstandings, which directly boosts customer satisfaction.

A Real-World Example of Nearshore ROI

Let’s break it down with a practical scenario. An e-commerce company in California is deciding between two call center partners for their upcoming holiday rush.

- Option A (Offshore): A provider in Southeast Asia comes in with an attractive rate of $12 per hour.

- Option B (Nearshore): CallZent in Tijuana offers a rate of $18 per hour.

On paper, Option A looks like a no-brainer. But when you dig deeper, the hidden costs of managing a distant, culturally misaligned team start to surface.

With the offshore partner, the company’s managers are stuck scheduling late-night calls for training. When a critical issue with a new promotion blows up, the 14-hour time difference means a full business day is lost before the problem is even addressed. On top of that, customer feedback shows frustration with agents who struggle to understand regional accents.

The true cost of an outsourcing partner isn’t just their hourly rate; it’s the total investment of time, resources, and brand reputation required to make the partnership successful.

The nearshore team in Tijuana, however, operates on Pacific Standard Time. The company’s managers can easily visit the facility for in-person training. When the same promotional issue pops up, a quick video call gets it sorted in under an hour. Best of all, customers report feeling understood, leading to higher CSAT scores.

Even with a higher hourly rate, the nearshore option delivers a far superior ROI by cutting down management overhead, speeding up problem resolution, and protecting the brand’s reputation. This is why a detailed analysis of nearshore vs. offshore outsourcing costs and risks is so critical.

Tapping into a Bilingual Talent Pool

One of the biggest wins of a nearshore location like Tijuana is immediate access to a large, highly skilled bilingual workforce. These agents are fluent in English and are native Spanish speakers, allowing you to serve a much broader customer base with a single, integrated team.

This dual-language capability delivers key benefits:

- Expanded Market Reach: Seamlessly support both your English and Spanish-speaking customers.

- Cost Efficiency: Avoid the extra cost and complexity of hiring separate, specialized teams for each language.

- Enhanced Customer Experience: Provide native-level support that builds trust and a stronger connection to your brand.

Ultimately, choosing a nearshore partner is an investment in efficiency, quality, and alignment that pays dividends far beyond simple hourly rate savings.

Calculating Your True ROI Beyond the Hourly Rate

It’s one of the oldest traps in outsourcing: you see a proposal with an unbelievably low hourly rate and think you’ve found a bargain. But that number almost never tells the whole story. More often than not, it’s a hook designed to get you in the door before the real costs start piling up.

To make a smart decision, you have to stop asking, “How much does this cost per hour?” and start asking, “What is the total value this partnership will bring my business?” A cheap service that frustrates your customers isn’t a good deal; it’s a hidden liability that chips away at your brand. A quality partner, on the other hand, is a revenue driver.

Uncovering Hidden Call Center Outsourcing Costs

Before you can get a clear picture of your ROI, you need to know what to look for. Hidden costs are the little “gotchas” that can turn a seemingly great deal into a financial headache. It’s crucial to ask about them upfront.

- One-Time Setup and Integration Fees: Does the vendor charge for initial setup, scripting, or connecting their systems to your CRM? These fees can run from a few hundred to several thousand dollars.

- Extended Training Periods: If a vendor’s agents take forever to get up to speed, you’re paying for that learning curve. Inexperience or high turnover leads to longer calls and wasted money.

- High Agent Churn: A call center with a revolving door is a massive red flag. You’re constantly paying to train new people on your business, which tanks service quality.

- Poor Performance Costs: This is the big one. Low Customer Satisfaction (CSAT) scores, high call abandonment rates, and unresolved tickets lead directly to lost customers and a damaged reputation.

When you press potential partners on these specific points, you force a much more honest conversation about total call center outsourcing costs, not just the rate on the flyer.

A Simple Framework for Calculating True ROI

Calculating your real return means looking at both direct savings and indirect gains. It’s not just about what you save; it’s about what you gain. Thinking through the complete ROI of outsourcing call centers makes it clear just how much value a great partner can deliver.

Here’s a straightforward way to map it out:

- Calculate Total Outsourcing Costs: Start with the vendor’s price. Then, add in any one-time setup fees, technology costs, and the time your own team will spend managing the partnership.

- Estimate In-House Costs: Now, add up what it would cost to do the same job internally. Be honest—include agent salaries, benefits, recruiting, training, management overhead, software licenses, and office space.

- Quantify Performance Gains: This is where the true value shines. Put a dollar amount on what better performance means for your business. For example:

- Improved Customer Retention: What would a 2% boost in customer retention be worth to you in annual revenue?

- Increased First-Call Resolution: How much time and money do you save when 15% more problems are solved on the first contact?

- Reduced Call Handle Time: Shaving just 30 seconds off the average call adds up to massive efficiency gains over thousands of interactions.

When you weigh the total cost against the total value—the hard savings and the performance gains—you get a much clearer picture of your true ROI. This method helps you choose a partner who delivers real business results, not just a temptingly low price tag.

Your Vendor Selection and Negotiation Checklist

Picking an outsourcing partner is one of the most critical decisions you’ll make for your customer experience. The right partner becomes a true extension of your team, helping you build loyalty and drive growth. The wrong one can drain your resources and damage your brand.

Think of this checklist as your guide to navigating the process. It’s designed to help you ask the right questions and find a partner who’s genuinely aligned with your goals. A transparent, collaborative vendor will welcome this level of detail.

Step 1: Scrutinize Their Expertise and Reputation

Before you even glance at a proposal, it’s time to do some homework. A vendor’s track record is one of the best predictors of your future success. You need a partner who understands the unique challenges in your market, whether you’re in e-commerce, healthcare, or finance.

Start by digging into the specifics:

- Case Studies and References: Ask for concrete examples of their work with companies similar to yours in size and industry. A history of success with clients who look like you is a massive green flag.

- Agent Experience and Training: How do they find, train, and retain their agents? Look for a structured onboarding process and a culture that invests in ongoing development.

- Industry-Specific Compliance: If you’re in a regulated field like healthcare (HIPAA) or finance (PCI), this is non-negotiable. Ask for proof of their certifications and details of their compliance training protocols.

Step 2: Dive Deep Into Security and Scalability

Your customer data is one of your most valuable assets, and protecting it has to be a top priority. At the same time, you need a partner who can grow with you, flexing their team up or down as your needs change without missing a beat.

Drill down on their technical and operational chops:

- Data Security Measures: How are they protecting sensitive information? Get specific about their data encryption, network security, access controls, and the physical security of their facilities.

- Technology Stack: What CRM, ACD, and quality assurance software do they use? Make sure their tech is modern, reliable, and capable of integrating with your existing systems.

- Scalability Plan: What’s their process for adding or removing agents? A solid partner should be able to scale your team within a reasonable timeframe without letting quality slip.

For a more detailed look at this crucial step, check out our guide on how to find and vet the best call center outsourcing companies, which provides even more questions to ask.

Step 3: Dissect the Service Level Agreement (SLA)

The SLA is the rulebook for your partnership. It’s where promises are put on paper, defining the specific, measurable performance standards the vendor commits to. It also lays out what happens if they don’t meet them. Don’t just skim this document—read every line.

A vague SLA is a major red flag. A great partner will work with you to define clear, meaningful metrics that are directly tied to your business objectives.

Look for crystal-clear definitions and targets for key metrics like:

- First-Call Resolution (FCR): The percentage of issues they solve on the first contact.

- Average Handle Time (AHT): How long it takes, on average, to handle an interaction.

- Customer Satisfaction (CSAT): How happy your customers are with the service they received.

- Service Level: The percentage of calls answered within a set time (e.g., 80% of calls in 20 seconds).

- Penalties and Remedies: What happens if the vendor consistently misses these targets? The SLA needs to clearly outline any service credits or other remedies.

Negotiating for real value, not just the lowest price, is the final and most critical piece of the puzzle. Use the insights you’ve gathered to build a partnership based on shared goals and mutual success.

Got Questions About Outsourcing Costs? We Have Answers.

Diving into the world of call center outsourcing can feel like navigating a maze of pricing models and hidden fees. It’s natural to have questions. To help you move forward with confidence, we’ve tackled some of the most common ones we hear from businesses just like yours.

What is a realistic hourly rate for good nearshore services?

For a high-quality nearshore partner in a prime location like Tijuana, you should expect to see all-inclusive hourly rates between $15 and $25 USD per agent. This is the sweet spot that gives you significant savings compared to the $30-$40+ you’d pay for a comparable US-based center. More importantly, that price secures a much higher caliber of bilingual, culturally-aligned agent talent than many offshore locations that dangle rates below $12 an hour.

How can I avoid being hit with unexpected fees?

The best way to sidestep surprise charges is to demand total transparency from the get-go. Ask every potential vendor for a detailed cost breakdown that clearly separates what you’re paying for labor, technology, management, and training.

Always ask about:

- One-time setup or integration fees

- Software licensing costs

- Penalties for going over certain call volumes

- Extra charges for custom reports or specialized training

A reputable partner won’t hesitate to give you a clear, all-in proposal and will spell out every potential cost in the Service Level Agreement (SLA) before you sign.

Is a performance-based model actually cheaper than paying per hour?

Not necessarily—it really depends on the job. A per-resolution model can be cost-effective for straightforward tasks like setting appointments or qualifying leads. However, for more complex customer service roles that demand real problem-solving, a per-hour or per-seat model almost always delivers better overall value. The risk with a per-ticket model for complex issues is that it can incentivize agents to close tickets as fast as possible, not to actually solve the customer’s problem for good.

Get a Transparent Call Center Cost Quote

CallZent delivers nearshore call center solutions with no hidden fees, full transparency, and measurable ROI.

Ready to get a clear, transparent quote tailored to your business needs? CallZent provides custom nearshore solutions that deliver exceptional value without the hidden fees. Contact us today for a no-obligation consultation.