Outsourcing Strategy

Nearshore vs Offshore Outsourcing:

Costs, Risks, and Which Model Actually Wins

Is outsourcing really just a trade-off between price and proximity? This in-depth guide breaks down the real costs, hidden risks, and operational impact of nearshore vs offshore outsourcing—so U.S. businesses can choose the model that delivers the best long-term ROI.

TL;DR: Nearshore vs Offshore Outsourcing

- Nearshore outsourcing (e.g., Mexico) offers better collaboration, cultural alignment, and lower total cost of ownership (TCO), making it ideal for complex, high-touch operations.

- Offshore outsourcing (e.g., Asia) delivers the lowest hourly rates but introduces hidden costs tied to time-zone gaps, quality control, and higher attrition.

- The winner isn’t the cheapest option—it’s the model that aligns with your risk tolerance, compliance needs, and customer experience goals.

Is finding the right outsourcing partner a simple choice between price and proximity? When you dig into the nearshore vs offshore debate, it often feels like a straightforward trade-off: go nearshore for better collaboration and cultural familiarity, or go offshore for what looks like the lowest possible price tag. But what if the lowest hourly rate isn’t actually the cheapest option in the long run?

The right choice really hinges on what you value more—seamless integration with your team or pure labor cost savings. For many US businesses, the answer isn’t as clear-cut as it once seemed.

Nearshore vs Offshore: A Quick Strategic Overview

Choosing where to outsource your call center or BPO services is a lot more nuanced than just looking at hourly rates. While the cost savings from an offshore partner in a place like the Philippines might jump off the page, those numbers often come with hidden challenges. We’re talking about significant time zone gaps, subtle language barriers, and cultural disconnects that can quietly chip away at customer satisfaction.

The nearshore vs offshore decision isn’t just about cost; it’s a strategic choice that directly impacts your operational flow and how customers see your brand.

On the flip side, a nearshore partner—like us here at CallZent in Tijuana, Mexico—operates in lockstep with North American business hours. This proximity makes real-time communication a breeze, simplifies collaboration, and ensures a much deeper cultural understanding. That’s a huge deal when your goal is delivering authentic, high-quality customer support. For a deeper dive into how these models stack up in today’s market, this Offshore vs Nearshore: A Modern Guide offers some great insights.

Key Differentiators at a Glance

To make a smart call, you have to look past the upfront costs and weigh the total value each model brings to the table. This is where a thoughtful approach, what we call “Smart Sourcing,” comes in. It’s all about balancing cost with quality, risk, and strategic fit. If you’re building out your decision framework, our strategic guide to outsourcing is a great place to start.

For a quick, side-by-side view, here’s how the two models fundamentally differ.

Quick Comparison Table: Nearshore vs Offshore

This table breaks down the core differences between nearshore and offshore outsourcing to give you a high-level snapshot for faster decision-making.

| Factor | Nearshore Outsourcing (e.g., Mexico) | Offshore Outsourcing (e.g., Asia) |

|---|---|---|

| Time Zone | Aligned (0-3 hours difference from the US) | Misaligned (8-12+ hours difference) |

| Collaboration | Enables real-time, agile communication and problem-solving. | Often requires asynchronous communication, leading to delays. |

| Cultural Affinity | High cultural and linguistic alignment with North America. | Significant cultural and communication style differences. |

| Travel & Oversight | Quick, affordable travel for training and management. | Expensive, time-consuming travel; harder to oversee. |

| Data Security | Often shares similar legal frameworks (e.g., USMCA). | Operates under completely different legal and data privacy laws. |

| Cost Model | Moderate cost savings with higher overall value. | Highest potential cost savings, but with hidden expenses. |

Ultimately, the best partner feels like a true extension of your own team. The nearshore model is built for businesses that can’t compromise on high-touch, collaborative, and culturally tuned-in customer interactions.

Calculating the True Cost in the Nearshore vs Offshore Debate

When you’re comparing nearshore vs offshore, it’s tempting to let the hourly rate drive your decision. But focusing only on that number is a classic mistake that can backfire, leading to surprise expenses and mediocre results. The real financial picture only comes into focus when you calculate the Total Cost of Ownership (TCO), which digs into the hidden factors that truly define your return on investment.

The real cost of outsourcing isn’t the hourly rate; it’s the total investment required to achieve your desired outcome.

A cheap offshore rate looks like an easy win on a spreadsheet, but those initial savings can get eaten up fast by indirect costs. We’re talking about things like higher management overhead, pricey travel for training and quality control, and the constant need for rework because of communication gaps.

Beyond the Hourly Rate: The Hidden Variables

Think about it this way: an offshore team might charge $10 per hour, while a nearshore team comes in at $15 per hour. On paper, the choice seems obvious. But what happens when the offshore team needs double the supervision from your managers because of the 12-hour time difference and cultural disconnects? Suddenly, you’re paying for your manager’s time on top of the agent’s rate, and those offshore “savings” start to evaporate.

Let’s break down the real variables that add up to your TCO:

- Management Overhead: Nearshore teams operating in the same or similar time zones are just easier to manage. Real-time check-ins are simple. On the other hand, managing an offshore team often means your leaders are stuck on late-night calls or waiting hours for email replies, tacking on unproductive time to their workday.

- Training and Travel: Getting a training team from the U.S. to Tijuana is a quick, affordable trip. Flying that same team to Southeast Asia? That’s a multi-day affair with jet lag and sky-high costs for flights and hotels. A simple training session balloons into a major logistical headache and expense.

- Rework and Quality Control: Cultural and language nuances are a huge deal in customer service. A nearshore agent who intuitively understands North American customer expectations is far less likely to make mistakes that need fixing. This leads directly to better First Call Resolution (FCR) rates and happier customers.

The Financial Impact of Employee Turnover

Another killer cost that gets overlooked in the nearshore vs offshore debate is agent attrition. High turnover is a silent budget drain.

Industry data consistently shows offshore BPOs can struggle with higher churn, sometimes hitting 20–30% annually. Every time an agent walks out the door, you’re back to square one, paying to recruit, hire, and train their replacement. You also lose valuable institutional knowledge, which can drag down your team’s performance for weeks or even months.

Nearshore centers typically have lower turnover because the cultural fit is better and the work schedules are more manageable. This stability creates a more experienced team, which translates directly into long-term savings and consistent service quality.

While older data suggested offshore models could offer savings of 30–55% in a perfect world, modern analyses show nearshore partnerships reliably deliver a 25–40% savings over onshore hiring—with way less friction.

At the end of the day, a slightly higher nearshore rate often works out to a lower TCO and a much stronger ROI. For a complete picture of all the potential expenses involved, we highly recommend reading our guide to a full call center outsourcing cost breakdown. It gives you a practical framework for picking a partner based on sustainable value, not just a line-item expense.

How Geographic Proximity Impacts Your Operations

When you’re weighing nearshore vs offshore, geography is so much more than a point on a map. It’s the invisible hand that shapes collaboration, workflow, and ultimately, the quality of your customer conversations. The engine of any high-performing team is seamless, real-time communication, and proximity is the fuel that keeps it running.

A nearshore partner, just a short flight away in a place like Tijuana, operates in the same daily rhythm as your U.S.-based business. This isn’t a minor detail—it’s a game-changer. It means your teams can actually work together in real-time without the drag of a 12-hour time difference.

Time Zone Alignment: A Nearshore Strategic Advantage

Picture this: a critical customer issue pops up at 3 PM Pacific Time. With a nearshore team, you can jump on a video call instantly, pull in the right agents and managers, and get it solved before everyone signs off for the day. That kind of agile, responsive workflow makes your outsourced team feel like a genuine extension of your in-house staff.

Now, replay that scenario with an offshore team in Asia. That 3 PM PT problem lands right in the middle of their night. The issue just sits there, unresolved for hours, waiting for their workday to start. That communication lag creates delays, frustrates customers, and can easily turn small hiccups into major headaches.

When your teams work the same hours, you solve problems in minutes, not days. That speed is a competitive edge that directly boosts customer satisfaction and operational agility.

The strategic value here is massive. As you’re looking at your options, think about the practical, day-to-day wins that come from shared working hours.

- Real-Time Problem-Solving: Tackle urgent issues the moment they happen, without waiting for another hemisphere to wake up.

- Agile Workflows: Run daily stand-ups, training sessions, and strategy meetings as if everyone were in the same building.

- Stronger Team Integration: Build a cohesive culture where your outsourced agents feel truly connected to your company’s mission.

For a deeper look into this crucial factor, check out our insights on the importance of time zone alignment in call center outsourcing.

The Nuanced Impact of Cultural Affinity

Beyond just time zones, cultural affinity is a powerful—and often overlooked—factor in the nearshore vs offshore debate. This isn’t just about speaking the same language. It’s about sharing communication styles, business etiquette, and a gut-level understanding of what North American customers expect.

A nearshore agent in Mexico, for instance, is already immersed in North American media, consumer trends, and social norms. That shared context means they can build rapport with customers more naturally, pick up on subtle cues, and handle conversations with an empathy that feels authentic. This cultural fluency translates to fewer misunderstandings, less customer friction, and better interactions all around.

This alignment also speeds everything up. Industry reports show that nearshore partnerships can deliver faster collaborative velocity—often 18–25% faster on projects compared to offshore models. That speed is a direct result of smaller time-zone gaps and similar work cultures, which have made Latin America a go-to for North American companies.

When you get rid of the constant need to explain cultural nuances or correct communication missteps, your whole operation runs smoother. The result is a direct, positive impact on key metrics like Customer Satisfaction (CSAT) scores and First Call Resolution (FCR) rates, turning proximity into a measurable driver of quality and performance.

Navigating Security and Geopolitical Risk

Choosing an outsourcing partner is about more than just hitting operational targets—it’s a critical decision in risk management. When you stack up nearshore vs offshore, you’re not just looking at dots on a map; you’re assessing entirely different security and stability profiles. For any North American business, data security isn’t just an IT line item; it’s the bedrock of customer trust.

The right partner has to operate in a stable environment with predictable legal frameworks. This is where the nearshore model, especially in a place like Tijuana, really starts to pull ahead.

Why Nearshore Aligns with North American Data Privacy Laws

Data may not respect borders, but data privacy laws certainly do. A major headache with offshore outsourcing is trying to navigate a tangled web of legal systems that have little in common with North American standards like the California Consumer Privacy Act (CCPA) or Canada’s PIPEDA. Trying to enforce a contract or protect your intellectual property can turn into a messy, cross-continental affair.

Nearshore locations, on the other hand, often share much closer legal and economic DNA. Trade agreements like the United States-Mexico-Canada Agreement (USMCA) create a far more stable and predictable business climate. This shared framework simplifies contracts, puts real teeth into IP protections, and gives you a clear path for legal recourse if things go sideways.

For businesses in sensitive industries, this alignment isn’t just a nice-to-have; it’s non-negotiable.

- Healthcare: If you’re handling patient data, you need a partner who lives and breathes the strict requirements of HIPAA.

- Finance: Protecting financial information under standards like PCI-DSS is paramount for banks, fintech, and insurance providers.

- E-commerce: Keeping customer payment details and personal information locked down is fundamental to maintaining trust and avoiding a data breach disaster.

In outsourcing, legal and political stability isn’t just a perk—it’s a core component of business continuity. A partner operating under a familiar legal structure dramatically lowers your risk exposure.

The Geopolitical Factor in Your Decision

Beyond the fine print of legal frameworks lies the bigger picture: the geopolitical stability of your partner’s home base. Some offshore regions, while tempting on price, can be volatile—prone to unpredictable political shifts, trade disputes, or shaky infrastructure. These wildcard factors can throw a real wrench in your operations, from sudden regulatory whiplash to complete service blackouts.

Nearshore outsourcing to Mexico offers a much more stable and integrated alternative. Thanks to its deep economic ties and sheer proximity to the U.S., Mexico provides a resilient environment for business. This stability has become a massive draw for companies looking to de-risk their supply chains. In fact, recent analysis shows that global tensions pushed 40%–60% of enterprise sourcing decisions toward nearshore as a risk-diversification strategy. You can see more on how market trends are favoring nearshore stability in this in-depth 2025 U.S. Nearshore Report.

At the end of the day, picking a nearshore partner is an investment in a secure, compliant extension of your own operations. It’s about building a partnership that is resilient by design, protecting your data and ensuring your business can keep running without interruption. To get a feel for the specific protocols in place, take a look at our detailed overview of security and compliance in Mexico BPOs. This approach ensures your outsourcing decision strengthens your business instead of exposing it to risk you don’t need.

When Nearshore is the Only Real Choice

Theory is great, but let’s talk about what actually works on the ground. When you’re weighing nearshore vs offshore, some industries discover that the nearshore model isn’t just a nice-to-have—it’s the only option that makes sense for their core business. For North American companies in heavily regulated or customer-first sectors, this isn’t about saving a few extra bucks.

It’s about managing risk, nailing compliance, and delivering a customer experience that an offshore partner, frankly, struggles to replicate. Here are a few scenarios where nearshore wins, hands down.

Healthcare: Where Empathy and Compliance Are Non-Negotiable

The entire healthcare industry is built on trust and runs on a tightrope of regulations. Patient conversations demand a ton of empathy and careful communication, and every piece of data is locked down by laws like the Health Insurance Portability and Accountability Act (HIPAA).

There’s zero room for error here. A nearshore partner, say in Tijuana, operates within a legal system that’s already in step with North American data privacy laws. This makes ticking all the HIPAA compliance boxes much, much simpler.

Think about this everyday situation:

A patient calls their insurance company, totally stressed out and confused about a denied claim. They don’t just need a script read to them; they need someone to listen and guide them with genuine care.

- Nearshore Solution: An agent who gets the cultural nuances of the U.S. healthcare system can handle that call with real empathy. They understand the frustration behind the words and can break down complex insurance jargon in a way that feels helpful, not cold. That’s how you build trust and keep patients happy.

- Offshore Challenge: An offshore agent, even with the best training, is likely to miss those subtle emotional cues. The conversation feels robotic and scripted, which only makes the patient more frustrated and can turn a simple problem into a major complaint.

Finance: Where Security and Sharp Problem-Solving Are Everything

When it comes to financial services—banking, fintech, you name it—security is the whole game. Following the Payment Card Industry Data Security Standard (PCI-DSS) isn’t optional, and when people’s money is involved, they expect you to solve problems, fast. One tiny slip-up can shatter trust and open the door to huge liabilities.

The nearshore vs offshore decision here is really a risk management decision. A nearshore team gives you two critical advantages: tight security alignment and the ability to work together quickly on complex financial issues.

When a customer’s financial security is on the line, real-time, collaborative problem-solving isn’t a nice-to-have—it’s a must. Nearshore’s shared time zones make that happen.

Picture this: a customer calls in a panic, thinking they’ve spotted fraud on their account. Every second counts, and you need to act immediately.

- Nearshore Solution: The nearshore agent can flag the issue to a fraud specialist and work directly with your in-house team at the same time. Because everyone is working the same business hours, the problem gets sorted out in minutes. The account is secured, and the customer can breathe a sigh of relief.

- Offshore Challenge: With a 12-hour time difference, the agent takes the initial report, but a real fix has to wait until your U.S. team is back online. That delay leaves the account vulnerable and the customer feeling anxious and exposed for hours.

High-Growth SaaS: Where Agile Tech Support Fuels Retention

Software-as-a-Service (SaaS) companies live and die by customer loyalty, and that loyalty is built on outstanding, quick-thinking technical support. These businesses move fast, with product features changing all the time and customer feedback driving the next update.

The support team isn’t just answering tickets; they’re a core part of the product experience. Nearshore outsourcing delivers the kind of integrated, collaborative support that tech companies need to stay agile and keep users from churning. A nearshore team can truly act like an extension of your own product and engineering teams—a dynamic that’s almost impossible to pull off with an offshore partner.

So, when we look at the needs of these key industries, the choice becomes pretty obvious. You need cultural fluency, real-time collaboration, and specialized compliance. A nearshore partner brings that unique mix to the table, providing the best path for both growth and stability. To get a better sense of how we put this into practice, check out the specific industries we serve and see our custom solutions in action.

Here’s a quick guide to help you decide which model aligns best with your industry’s specific demands. Think of it as a cheat sheet for making the right call based on your operational DNA.

Decision Matrix: Nearshore vs Offshore by Industry Need

| Industry Requirement | Optimal Choice: Nearshore | Viable Choice: Offshore | Key Consideration |

|---|---|---|---|

| HIPAA & Data Privacy (Healthcare) | Nearshore is essential due to legal framework alignment and simpler compliance oversight. | Risky. Requires extensive, costly legal and security vetting to bridge regulatory gaps. | The cost of a data breach far outweighs any potential labor savings from offshore. |

| PCI-DSS & Security (Finance) | Nearshore provides real-time collaboration for fraud detection and shared business hours for escalations. | Possible for basic, non-sensitive tasks, but not for complex account management or fraud resolution. | Time-zone delays in resolving financial issues create significant customer trust and liability issues. |

| Complex Problem-Solving (SaaS/Tech) | Nearshore excels with agents who share cultural context and can act as an extension of your internal team. | Suitable for Tier 1, scripted support, but struggles with nuanced, unscripted technical challenges. | High-value customers expect sophisticated, consultative support, not just reading from a knowledge base. |

| High-Touch Sales & Retention (E‑commerce) | Nearshore drives better results through cultural understanding, leading to higher conversion and loyalty. | Can handle transactional tasks like order status but is less effective in building brand affinity. | A brand’s voice and personality are hard to replicate without deep cultural fluency. |

| 24/7 Cost-Sensitive Support (Telecom) | Offshore can be a strong fit for follow-the-sun models where cost is the primary driver. | Nearshore can provide 24/7 coverage but at a higher price point than Asian hubs. | Balance the need for constant availability with the quality of interaction during your peak business hours. |

Ultimately, the decision comes down to your priorities. If your business hinges on trust, compliance, and nuanced customer interactions, the proximity and cultural alignment of a nearshore partner aren’t just benefits—they’re fundamental requirements for success.

Making Your Final Decision in the Near Shore vs Offshore Choice

You’ve seen the breakdown of nearshore vs offshore. Now it’s time to make a decision. Choosing the right partner isn’t about chasing the lowest price tag; it’s about finding an extension of your team that aligns with your operational needs, company goals, and tolerance for risk.

Think of this final checklist as your guide for turning all that analysis into concrete, actionable steps. Use these questions to steer your conversations with potential BPO partners and cut straight through the sales fluff. They’ll help you see the real value—and potential pitfalls—of any outsourcing relationship.

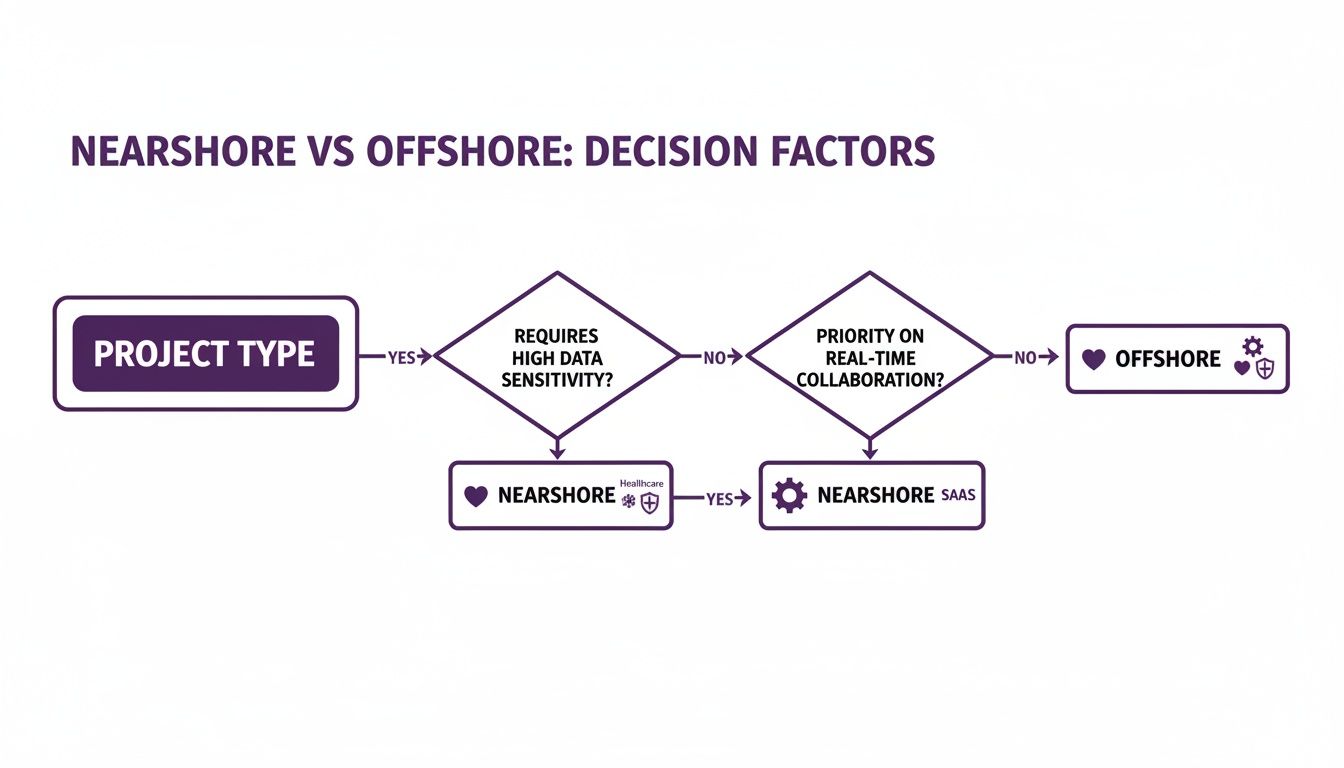

This decision tree gives you a quick visual guide for which model makes more sense for industries like healthcare, finance, and SaaS, especially when compliance and close collaboration are non-negotiable.

As you can see, when data sensitivity is high and you need your teams working in lockstep, nearshore is the clear winner for North American businesses.

The Vendor Vetting Checklist: Questions to Ask Potential Partners

As you start talking to potential partners, keep these critical areas front and center. The answers you get will paint a clear picture of their real-world capabilities and whether they’re a good cultural fit. For a deeper dive into this process, check out our guide on how to find and vet the best call center outsourcing companies.

1. Security and Compliance Protocols

- How do you guarantee compliance with my industry’s specific regulations (e.g., HIPAA, PCI-DSS, CCPA)?

- Can you show me documentation from your most recent security audits or certifications?

- Walk me through your physical and digital security measures. How exactly is my data protected?

2. Agent Training and Quality Assurance

- What does your standard agent training look like, and how do you tailor it for a new client like me?

- How do you measure and maintain call quality and agent performance on a daily basis?

- What’s your agent attrition rate? What are you doing to keep your best people?

3. Scalability and Flexibility

- What’s your game plan for handling an unexpected spike in call volume?

- If I need to scale my team up or down, what does that process actually involve?

- Can you share a case study of how you helped another client scale their operations successfully?

4. Performance Metrics and Reporting

- Which key performance indicators (KPIs) do you track right out of the box?

- How often will I get performance reports, and what information do they include?

- What kind of access will I have to real-time performance dashboards?

By asking these tough questions, you can move forward with confidence, knowing you’ve picked a partner that does more than just meet your budget—it elevates your entire customer experience.

Common Questions About Nearshore vs. Offshore

When you’re weighing your outsourcing options, it all comes down to a few key questions. Let’s tackle the most common ones that businesses ask when trying to decide between a nearshore and offshore partner.

What’s the Real Difference Between Nearshore and Offshore Outsourcing?

At its core, the difference is geography and how that impacts the way you work together. Nearshore outsourcing is about partnering with a provider in a neighboring country—think a U.S. company working with a team in Mexico. The big win here is the shared time zones, cultural similarities, and the sheer ease of travel, which makes collaboration feel almost in-house.

Offshore outsourcing, on the other hand, means you’re partnering with a company in a faraway country, like India or the Philippines. While the initial sticker price on labor is often the lowest, you’re trading that for some real logistical hurdles. We’re talking significant time zone gaps (8-12+ hours) and navigating completely different cultural and legal landscapes, which can make real-time communication a serious challenge.

Is Nearshore Actually More Expensive Than Offshore?

If you only look at the hourly rate for an agent, then yes, nearshore might seem pricier upfront. But that’s a rookie mistake. The true cost—what we call the total cost of ownership (TCO)—is often much lower with a nearshore partner.

Here’s why the math works out in favor of nearshore:

- Lower Management Overhead: When your teams share business hours, your managers aren’t burning the midnight oil just to sync up. That saves time and prevents burnout.

- Reduced Travel Costs: Flying a team to Mexico for training or a site visit is a quick, affordable trip. Flying them halfway across the world? Not so much.

- Higher Agent Retention: A better cultural fit and work-life balance mean agents stick around longer. That significantly cuts down on your recruiting and training costs, which are a major hidden expense.

Why Are So Many US Companies Choosing Latin America for Nearshore?

There’s a good reason U.S. businesses are increasingly looking south. The overlapping time zones are a massive advantage, allowing for the kind of agile, real-time collaboration that feels like your team is just down the hall, not a continent away.

Beyond that, the strong cultural connection and high English proficiency make a world of difference. Agents just get the nuances of the North American market, leading to smoother customer conversations and a better grasp of what your customers actually expect. It’s this blend of practicality and quality that drives better results.

The choice isn’t just about finding a vendor; it’s about building a partnership. Nearshore’s proximity and cultural sync-up create a more integrated, collaborative relationship from day one.

How Does Security Compare Between Nearshore and Offshore?

This is where the two models really diverge. Security and compliance are huge differentiators. Nearshore partners, especially in Mexico, often work under legal frameworks that closely mirror North American standards, thanks to agreements like the USMCA. This alignment makes it far simpler to stay compliant with data privacy laws like HIPAA and CCPA.

Offshore locations, however, operate under entirely different legal systems. This can introduce a lot of complexity—and risk—when you’re dealing with data protection, intellectual property, and even basic contract enforcement. For any business that handles sensitive customer information, the streamlined compliance of a nearshore partner offers a critical layer of security and, frankly, peace of mind.

🚀 Ready to Compare Offshore vs Nearshore for Your Business?

Talk to a CallZent expert to evaluate cost, quality, and ROI for your contact center strategy.

Ready to see how a nearshore partnership can elevate your customer experience while optimizing costs? At CallZent, we build dedicated teams that act as a true extension of your business. Discover our tailored nearshore solutions today.